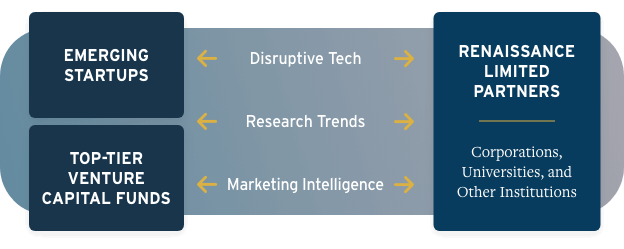

Through its investment in venture capital funds and its pioneering work connecting startups companies to those funds and to major companies looking for innovation, Renaissance is striving to drive forward both financial returns and regional growth.

Driving Regional Investment

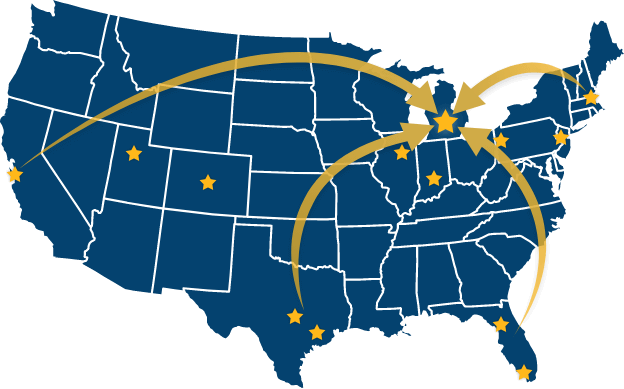

In many regions of the U.S., there is significant under-investment in high-potential startups. Our home state of Michigan ranks in the top ten by the Milken Institute in 2022 for R&D capacity but has traditionally lagged in total venture capital investment. This gap represents significant investment opportunities for venture capitalists and growth opportunities for the region. Renaissance is focused on closing this gap by creating stronger connections between startups in our region and national investors.

Renaissance works with partners across universities, accelerators, seed and angel funds to identify the region’s best startups, and then connects them with a national venture capital network, both on an individual basis and through Renaissance’s flagship UnDemo Day® events.

Renaissance’s success in attracting venture capital to Michigan has led to the creation of new funds in other parts of the U.S. utilizing the “Renaissance Model.”